ventura property tax payment

Pay Property Tax Online Ventura County. Median Property Taxes Mortgage 4483.

Property Tax Information Moorpark Ca Official Website

As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID.

. You can also pay your Ventura County property taxes by phone. 1st Installment is due. Each online creditdebit card transaction is limited to 9999999 including a service fee of 222 percent of the transaction amount minimum 149 per transaction.

Please note that when making online credit or debit card payments for your current year Unsecured Personal. The first installment is delinquent if payment is not received on or postmarked by December 10 the second installment is delinquent if payment is not received on or. County of Ventura - WebTax - Search for Property.

Property taxes are the main source of revenue for Ventura and other local public districts. To pay by phone call the Ventura County Treasurer-Tax Collectors Office at 805 654-3777. Learn all about Ventura County real estate tax.

You will need to provide. Low-value property tax changes SB 1493 Notification of Assessment. You may also pay online by using major credit cards or debit cards.

Ventura County Property Tax Payments Annual Ventura County California. Our detailed article on taxes in California can be found here. In California Marin County has the highest property tax with a tax rate of.

Tax Payments for Calendar Year 2022. Whether you are already a resident or just considering moving to Ventura County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. When are Secured Property taxes due in Ventura County California.

Mailed Payments - Ventura County. Secured Taxes - Ventura County. Box 51179 Los Angeles CA 90051-5479.

More details on paying property taxes. Treasurer-Tax Collector - Ventura County. Everything You Need To Know.

Mailed-in payments should be remitted to the tax collectors payment processor at PO. Besides counties and districts like hospitals many special districts such as water and sewer treatment. I am honored to work for you as the elected Assessor of Ventura County.

For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at. Pay - Ventura County. Tax Payments for Calendar Year 2021.

Secured Property Taxes in Ventura County are paid in two installments. Tax Payment History Property Address. Residents of Ventura County pay an average of 361 of their annual income in property taxes.

In 2017 the average property tax in Ventura County was81 percent.

Tax Collector Faq S Ventura County

Bilingual Report 70 Property Tax Break Available For Qualified Homeowners Amigos805 Com

Ventura County Ca County Clerk And Recorder Registrar Of Voters

Ventura County Community Development Corporation Facebook

Ventura County Top Ten Secured Property Tax Bills For Fiscal Year 2015 2016 Conejo Valley Guide Conejo Valley Events

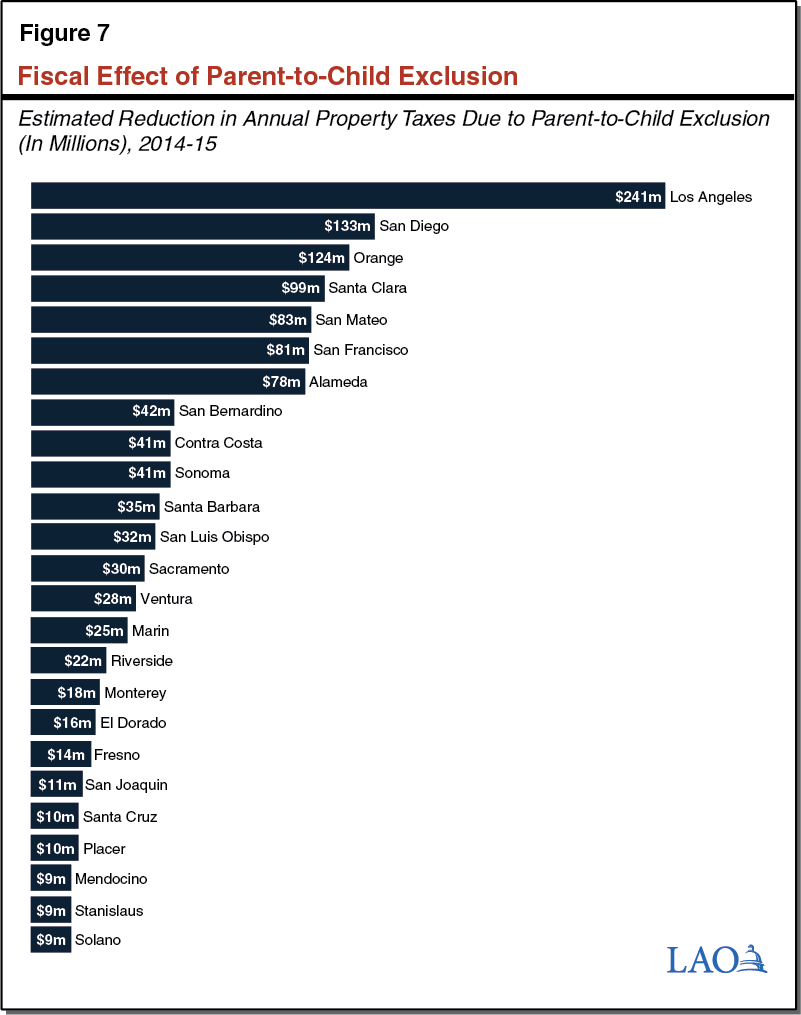

How Will Aging Baby Boomers Affect Future Property Tax Revenues

Ventura County People S Self Help Housing

What You Should Know About Property Taxes In California Nicki Karen

Alejandro Murillo Ventura County Property Taxes What You Need To Know Property Taxes Have Not Been Postponded To Local Governments By Any Federal Order For Current Property Owners Property Taxes Are

Ventura County Property Taxes Due The Mountain Enterprise

The Best Property Management Companies In Ventura California Of 2022 Propertymanagement Com

Property Taxes Collier County Tax Collector

Bilingual Report County Of Ventura Launches Webpage For Unclaimed Property Tax Refunds Amigos805 Com

Ventura County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

County Of Ventura Webtax Tax Payment History

If You Re Over 65 Here S One Of The Best Kept Secrets In Mass The Boston Globe